CUNA Mutual Group Form 40D(CU) 2014-2025 free printable template

Show details

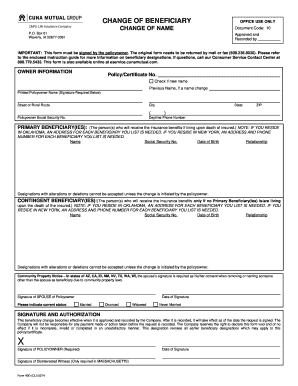

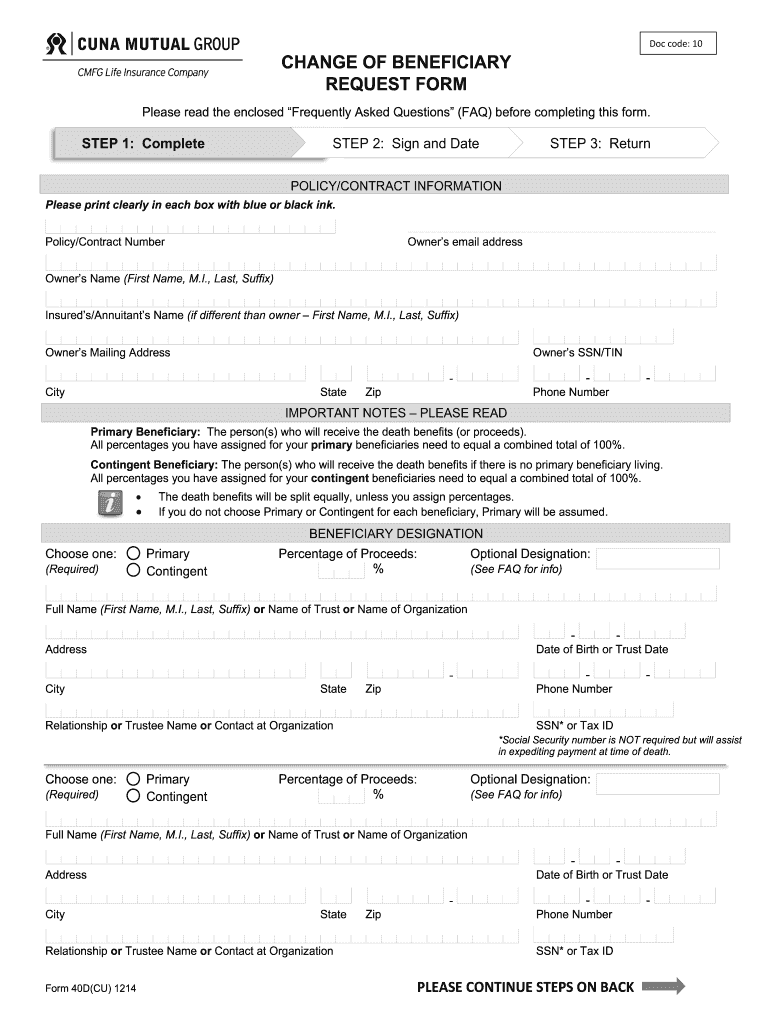

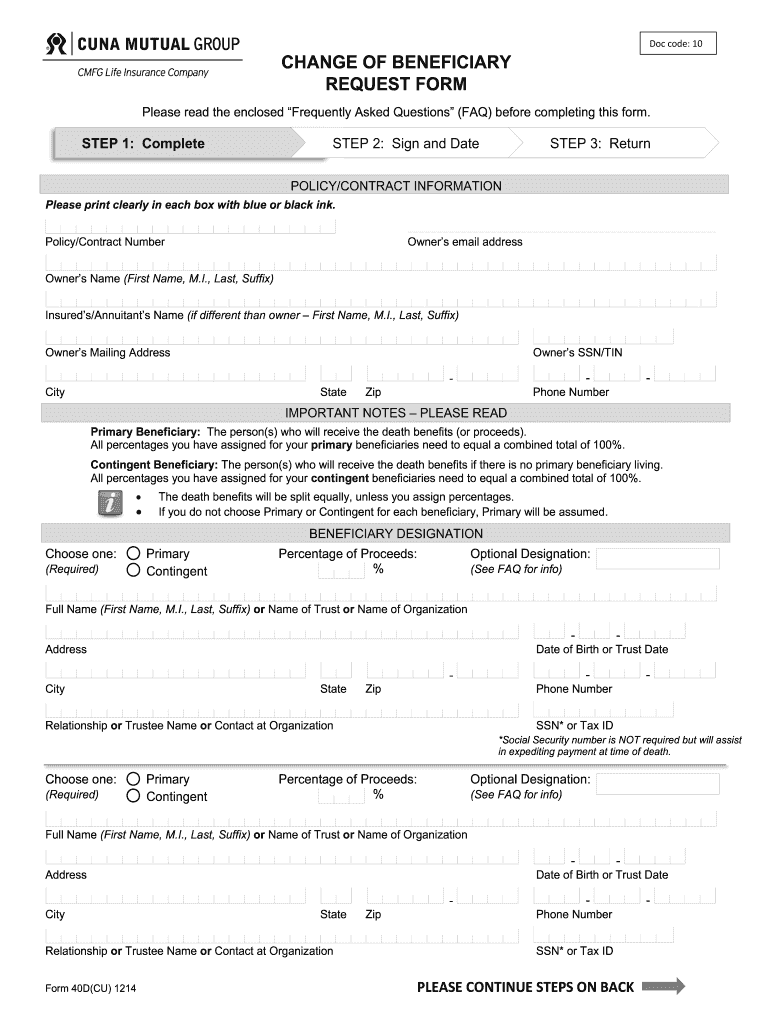

Form 40D CU 1214 PLEASE CONTINUE STEPS ON BACK If additional designations are needed please include a separate piece of paper with the policy/contract number the same information as above for each beneficiary and sign/date. Doc code 10 CHANGE OF BENEFICIARY REQUEST FORM Please read the enclosed Frequently Asked Questions FAQ before completing this form* STEP 1 Complete STEP 2 Sign and Date STEP 3 Return POLICY/CONTRACT INFORMATION Please print clearly in each box with blue or black ink....

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form change beneficiary request

Edit your beneficiary request printable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form beneficiary request form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 40d online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit beneficiary form template editable. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mutual form change beneficiary

How to fill out CUNA Mutual Group Form 40D(CU)

01

Begin by obtaining the CUNA Mutual Group Form 40D(CU) from the official website or your financial institution.

02

Fill in your personal information at the top of the form, including name, address, and contact details.

03

Provide your account or member number as required on the form.

04

Carefully read and complete the sections related to the purpose of the form, ensuring all relevant information is included.

05

Check any boxes that apply to your situation, such as claims or changes in coverage.

06

If necessary, include any supporting documentation as specified in the instructions.

07

Review your completed form for accuracy and completeness.

08

Sign and date the form where indicated, ensuring you have the authority to submit it.

09

Submit the form to the designated address or email provided in the instructions.

Who needs CUNA Mutual Group Form 40D(CU)?

01

Members of credit unions who are seeking insurance products from CUNA Mutual Group.

02

Individuals needing to make changes to their existing coverage or file a claim.

03

Administrators or representatives managing insurance needs on behalf of credit union members.

Fill

cuna mutual form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

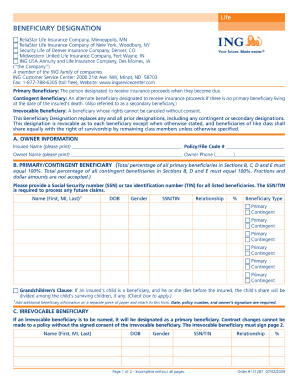

What is beneficiary forms?

Beneficiary forms are documents used by individuals to name beneficiaries for their bank accounts, retirement accounts, insurance policies, or other assets. By completing a beneficiary form, an individual can designate who they would like to receive their assets after they pass away.

Who is required to file beneficiary forms?

Beneficiary forms are typically required to be filed by the executor or administrator of an estate. It is the responsibility of this individual to make sure all beneficiary forms are properly completed and submitted to the appropriate authorities.

How to fill out beneficiary forms?

1. Gather the necessary information. Before you can complete a beneficiary form, you will need the full name, address, and Social Security number of the beneficiary, as well as the name of the account from which the beneficiary will be receiving the funds.

2. Fill out the form. The exact information required on the form will depend on the type of account—for example, a retirement account may require the beneficiary’s date of birth—so be sure to fill out all required fields.

3. Provide a death certificate. Most forms will require a copy of the death certificate of the account holder in order to verify that the beneficiary is the rightful heir to the account.

4. Sign and date the form. In most cases, the beneficiary will also need to sign and date the form before it can be submitted.

5. Submit the form. The form will need to be sent to the financial institution where the account is held in order to be processed.

What is the purpose of beneficiary forms?

Beneficiary forms are documents used to designate beneficiaries on certain types of accounts, such as life insurance policies, IRAs, and 401(k)s. A beneficiary is the person or organization that will receive the proceeds or benefits of the account in the event of the owner's death. By filling out a beneficiary form, the owner is able to designate exactly who will receive the money or benefits from the account.

What information must be reported on beneficiary forms?

The specific information that must be reported on beneficiary forms may vary depending on the type of account or policy and the specific institution or organization. However, typically, the following information is required:

1. Full legal name of the beneficiary: This includes first name, middle name (if applicable), and last name. It is important to provide the accurate and complete name of the beneficiary.

2. Social Security number (or other identification number): Beneficiary forms usually require the beneficiary's unique identification number, such as the Social Security number. This helps in distinguishing between individuals with similar names.

3. Date of birth: The beneficiary's date of birth is often required to confirm their age and eligibility to receive benefits.

4. Relationship to the account holder or policyholder: Beneficiary forms typically ask for the relationship of the beneficiary to the account or policy owner, such as spouse, child, sibling, or friend.

5. Contact information: The beneficiary's current mailing address, phone number, and email address may be asked for in order to facilitate communication in the future.

It is essential to thoroughly read the instructions provided on the specific beneficiary form to ensure accurate reporting and compliance with the requirements of the institution or organization.

How can I modify cuna form beneficiary without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including beneficiary request. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

Can I create an eSignature for the cuna mutual form change beneficiary in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your cuna mutual form beneficiary right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I edit cuna mutual form cu on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as mutual change beneficiary. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is CUNA Mutual Group Form 40D(CU)?

CUNA Mutual Group Form 40D(CU) is a form used by credit unions to report specific financial information, such as annual income and expenses, to the CUNA Mutual Group.

Who is required to file CUNA Mutual Group Form 40D(CU)?

Credit unions that are members of CUNA Mutual Group and meet certain financial thresholds are required to file Form 40D(CU).

How to fill out CUNA Mutual Group Form 40D(CU)?

To fill out CUNA Mutual Group Form 40D(CU), credit unions should follow the instructions provided with the form, ensuring all financial data is accurately reported and all required sections are completed.

What is the purpose of CUNA Mutual Group Form 40D(CU)?

The purpose of CUNA Mutual Group Form 40D(CU) is to gather essential financial information from credit unions to assist in risk assessment, underwriting, and the provision of insurance and financial services.

What information must be reported on CUNA Mutual Group Form 40D(CU)?

Information that must be reported on CUNA Mutual Group Form 40D(CU) includes annual income, expenses, assets, liabilities, and other relevant financial metrics.

Fill out your CUNA Mutual Group Form 40DCU online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Beneficiary Request Fill is not the form you're looking for?Search for another form here.

Keywords relevant to beneficiary request blank

Related to beneficiary request edit

If you believe that this page should be taken down, please follow our DMCA take down process

here

.